The W-9 Tax Form Guide: Fill Out the Request for TIN Online

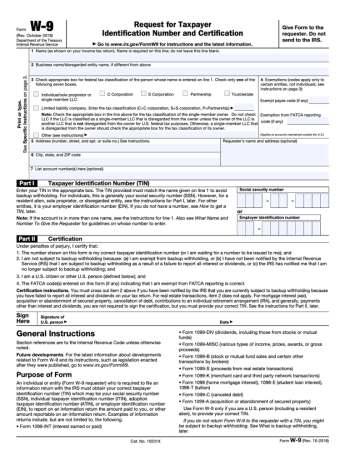

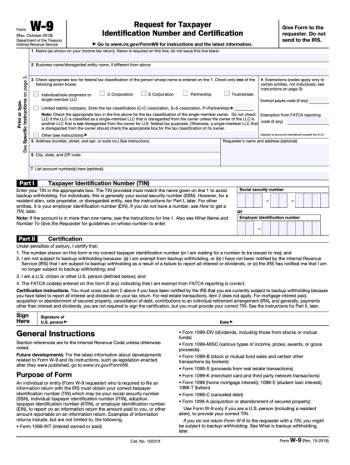

The IRS W-9 form, ordinarily used in the United States taxation system, is a crucial document that an individual or entity (requested by a third party) should complete accurately. This form, provided by the Internal Revenue Service, essentially requests the taxpayer's identification number. The intricate information requested should be appropriately filled, including the individual or entity's name, address, tax identification number, and certification. By completing a free fillable W-9 form in 2024, the person or entity also certifies that the details provided are accurate and up-to-date, ensuring the proper function of the nation's tax system.

Our website, w9-fillable-form.com, is invaluable in assisting citizens with filling out fillable W-9 for 2024 and submitting it correctly. We simplify dealing with this crucial request by providing practical resources like instructions and examples. Our website is committed to offering accessible, user-friendly tax form solutions, aiming to help individuals and entities alike easily navigate the usually complicated IRS W-9 fillable PDF structure. Consequently, this contributes significantly to ensuring citizens meet their tax responsibilities accurately and punctually.

Taxpayers Needing Form W-9 in 2024

The W-9 form is a necessary document for specific individuals and entities that the IRS (Internal Revenue Service) requires. Anyone who has provided services to a company as an independent contractor or did business with the company in a non-employee capacity must file a W-9.

Let's consider a hypothetical situation to understand this more clearly. Mr. Johnson is a freelance graphic designer who recently completed a project for a technology company. He's expecting payment in the year 2023 for his services. He's aware that he will need to complete the 2024 W-9 fillable form because he is not an employed staff member of the company. The form will aid the company in correctly generating its 1099-MISC copy, which is necessary for accurate tax reporting.

Let's consider a hypothetical situation to understand this more clearly. Mr. Johnson is a freelance graphic designer who recently completed a project for a technology company. He's expecting payment in the year 2023 for his services. He's aware that he will need to complete the 2024 W-9 fillable form because he is not an employed staff member of the company. The form will aid the company in correctly generating its 1099-MISC copy, which is necessary for accurate tax reporting.

Mr. Johnson, to simplify the process, decided to use a free W9 fillable form for 2024, which is available on our site. He celebrates the ease of the online template, acknowledging that the W-9 fillable PDF form ensures all the steps are straightforward, reducing the room for errors.

Completing your fillable W-9 tax form can seem daunting, but rest assured, it is a straightforward task. The following steps will guide you toward appropriately filling in this pivotal document. For those who deal with the printable copy, we recommend visiting printable-w9-form.org for more suitable instructions.

Free Fillable W-9 Form: Step-by-Step Filling Guide

- First, to find the blank W9 fillable form for 2024, follow the link on our website. Take a moment to download it onto your device, ensuring easy completion. Or you can fill it out online without saving the PDF.

- Start filling out the template by entering your name or your business's officially registered name. Remember, consistency in using legal names is essential.

- In the subsequent section, list any trade name or DBA (Doing Business As) if relevant.

- Next, fill in your federal tax classification. This could be an individual, S Corporation, LLC, Partnership, or Trust/estate.

- Then, provide your address and taxpayer identification number, which could be your social security number (SSN) or employer identification number (EIN).

- Lastly, certify Form W-9 fillable for 2024 by signing it. Remember to check everything you've filled out to avoid potential errors.

Pros of the IRS W9 Fillable Form

- An online template provides a neat and professional appearance, which can be especially important when submitting a copy to employers, clients, or business partners. It conveys a sense of professionalism and attention to detail.

- Filling out the fillable form W-9 in 2024 is often faster and more efficient than handwriting the information. You can easily navigate between fields, copy and paste information, and make corrections without manual erasing or crossing out.

- Lastly, using the W-9 2024 fillable form, you can save a digital copy of the completed sample for your records. This ensures that you have a backup of the data you provided, which can be valuable for future reference or if you need to provide the same information to multiple entities.

IRS Form W-9 & Deadline

There is no definitive due date regarding the IRS W-9 fillable form in 2024 because it's used to gather information, not to report income or pay taxes. Think of it like setting up your details with a race administrator before you start running.

However, it should ideally be completed and submitted before any payments or transactions are made. As for the penalties, if you neglect to provide a completed W-9 form upon request, you may be subject to 24% backup withholding on your payments. Simply put, the W-9 is like the information card you fill out at the doctor's office — it's not tied to a specific due date, but you need to complete it before any further steps can be taken.

Federal Form W-9: Popular Questions

- Are there exemptions for using the free IRS W-9 fillable form?There aren't specific exemptions for using the document itself; rather, the request is used to determine whether the recipient of income is subject to backup withholding. Some individuals or entities may be exempt from backup withholding based on their tax status. Still, this determination is made by the IRS based on the information provided on the W-9 template.

- Should I keep a copy of the completed IRS Form W-9 as a fillable PDF?Yes, it is a good practice to have a copy for your records. You may need the information on the W-9 for tax purposes, especially if you are a contractor or vendor who receives income.

- How much time do I need to complete an online fillable W-9 form?It can vary depending on how familiar you are with the request and how quickly you can gather the necessary information. Generally, it should not take a few minutes to complete if you have all the required information readily available.

- Does the free W-9 fillable for 2024 differ from the previous templates?The IRS periodically updates its templates, including Form W-9, to reflect tax laws or regulations changes. The relevant template was revised in 2018, and there are no updates. But we keep an eye out to provide you with the latest news.

- Can a foreigner use the W-9 form fillable online?Foreign individuals or entities would typically use Form W-8 series (e.g., W-8BEN) to provide taxpayer identification information to U.S. payers. Form W-8 is used to certify foreign status and claim applicable tax treaty benefits. So, foreign persons should refrain from using the W-9 request.

More W-9 Form Instructions

-

![image]() W-9 Fillable Form for 2023 First things first, the IRS W9 fillable form in 2023 is a critical document to provide information to the Internal Revenue Service about your tax status in the United States. This form verifies your identity and certifies that you are not subject to backup withholding. It is typically requested by t... Fill Now

W-9 Fillable Form for 2023 First things first, the IRS W9 fillable form in 2023 is a critical document to provide information to the Internal Revenue Service about your tax status in the United States. This form verifies your identity and certifies that you are not subject to backup withholding. It is typically requested by t... Fill Now -

![image]() Fillable W-9 Form (PDF) In most instances, as a U.S. citizen, whether individual or corporate, you may be required to complete and submit a W-9 form. This document is instrumental in accurately identifying taxpayers who must report an income received. Now think about an instance where a financial institution requests your... Fill Now

Fillable W-9 Form (PDF) In most instances, as a U.S. citizen, whether individual or corporate, you may be required to complete and submit a W-9 form. This document is instrumental in accurately identifying taxpayers who must report an income received. Now think about an instance where a financial institution requests your... Fill Now -

![image]() Fillable W9 Tax Form Before delving into the important topic of safeguarding personal information during tax data processing, it's paramount to understand the role and function of a fillable W-9 tax form. This form is a critical document that the Internal Revenue Service (IRS) in the United States employs to get accurat... Fill Now

Fillable W9 Tax Form Before delving into the important topic of safeguarding personal information during tax data processing, it's paramount to understand the role and function of a fillable W-9 tax form. This form is a critical document that the Internal Revenue Service (IRS) in the United States employs to get accurat... Fill Now -

![image]() Fillable IRS Form W-9 If you are a contractor, it's critical to understand the requisite tax paperwork, such as the fillable W-9 form from the IRS. Businesses generally request this form from freelancers and independent contractors. This document is fundamental to complying with the IRS's tax obligations and prevents pot... Fill Now

Fillable IRS Form W-9 If you are a contractor, it's critical to understand the requisite tax paperwork, such as the fillable W-9 form from the IRS. Businesses generally request this form from freelancers and independent contractors. This document is fundamental to complying with the IRS's tax obligations and prevents pot... Fill Now