Tax Form W-9: Protecting the Personal Data

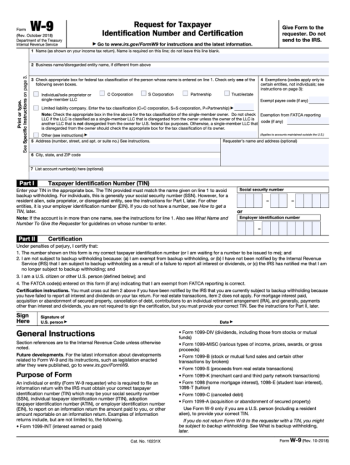

Before delving into the important topic of safeguarding personal information during tax data processing, it's paramount to understand the role and function of a fillable W-9 tax form. This form is a critical document that the Internal Revenue Service (IRS) in the United States employs to get accurate and updated information about independent contractors, freelancers, and non-employees. Its importance lies chiefly in the fact that it contains confidential personal data, which, if not properly managed, can lead to dire consequences like identity theft.

Fillable W-9 Tax Form & The Risk of Identity Theft

Sharing personal information online can always carry some risk. Completing a W-9 tax form fillable is not exempt from this danger. Amidst the worry, one must remember the significance of this form in one's financial dealings. Yet, the fear of one's personal details falling into the wrong hands is quite understandable. This is particularly true considering details like Social Security Numbers and other essential personal information are on these forms, making them a choice target for unscrupulous individuals.

Effective Measures to Mitigate Risks with Fillable W9 Tax Form

- Secure Digital Channels

Only ever complete a fillable W9 tax form via a secure digital channel. It is essential to ensure that your internet connection is private and secure. Avoid completing or sending your form via public Wi-Fi networks, as they can easily be compromised. - Up-to-date Anti-virus Software

Always ensure that your device, where you fill out the tax form, has the most recent security updates and up-to-date anti-virus software. This will help shield your gadget from security breaches and cyber-attacks. - Careful Management of Hard Copies

If you must keep a printed copy of your W-9 form, be sure to store it in a secure location. Never leave it lying around where just anyone can access it.

The W-9 Fillable Tax Form: Additional Precautionary Measures

- Contact Confirmation

When you are asked to fill out a W-9 fillable tax form, confirm first who it is coming from. Scammers often pose as employers or financial institutions to steal information. If you need clarification, contact your bank or employer directly to verify. - File Encryption

If you have to send your W-9 form by email, be sure to encrypt the file or the message. Encryption makes your file unreadable to anyone who needs the unique key to decode it. This is just another level of security to ensure your sensitive information is kept safe.

Despite the risks, providing a W-9 should be a smooth process. By following these pointers, you can comfortably send your necessary information, knowing that you have taken all the necessary precautions to protect your identity.

Related Forms

-

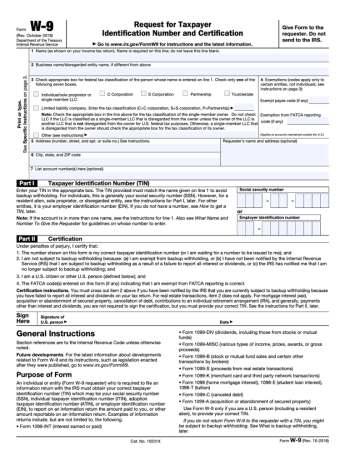

![image]() W-9 The IRS W-9 form, ordinarily used in the United States taxation system, is a crucial document that an individual or entity (requested by a third party) should complete accurately. This form, provided by the Internal Revenue Service, essentially requests the taxpayer's identification number. The intricate information requested should be appropriately filled, including the individual or entity's name, address, tax identification number, and certification. By completing a free fillable W-9 form in... Fill Now

W-9 The IRS W-9 form, ordinarily used in the United States taxation system, is a crucial document that an individual or entity (requested by a third party) should complete accurately. This form, provided by the Internal Revenue Service, essentially requests the taxpayer's identification number. The intricate information requested should be appropriately filled, including the individual or entity's name, address, tax identification number, and certification. By completing a free fillable W-9 form in... Fill Now -

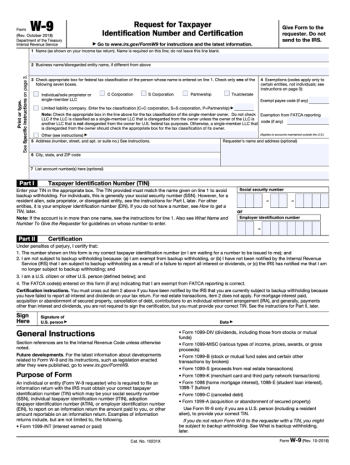

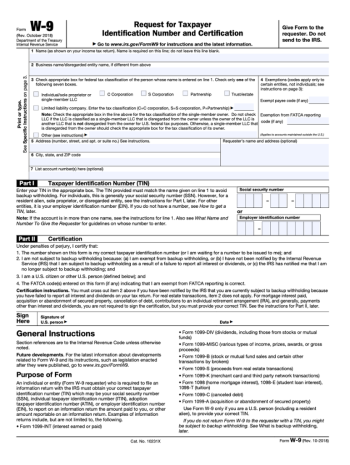

![image]() W-9 Fillable Form for 2023 First things first, the IRS W9 fillable form in 2023 is a critical document to provide information to the Internal Revenue Service about your tax status in the United States. This form verifies your identity and certifies that you are not subject to backup withholding. It is typically requested by those who pay you income, seeing as it provides them with an accurate taxpayer identification number (TIN) to report to the IRS. IRS Form W-9 for 2023: Keep Up With the Changes Like any other official document, the IRS revises the form periodically to comply with new taxation laws, requirements, and provisions. For instance, in the free W-9 fillable form for 2023, the IRS introduced sections to include the foreign individuals' foreign tax identifying number (FTIN). Since changes may affect how to correctly fill out the W-9 form, it is recommended to check the instructions provided by the IRS to avoid mistakes and potential penalties. Who Can and Cannot Use Form W-9 It's essential to understand that Form W-9 fillable for 2023 may not be for everyone. The form might be used only by the U.S. persons, including: citizens, resident aliens, specific types of trusts and estates, specific business entities. In other words, if you are a foreign individual, foreign business, or represent a foreign trust, you should not use W-9; instead, you will likely need to use Form W-8 series. Maximize the Benefits of the W-9 Form Filing and managing the IRS W9 form for 2023 fillable can seem a bit intimidating at first. Still, when done right, it can help avoid unnecessary tax intricacies. Pay special attention when filling out Section 2 of the template, which asks for your TIN. Providing valid and correct information in this section is important, as incorrect information may lead to backup withholding or penalties. Preparing the W9 Fillable Form for 2023 The perfect time to get acquainted and prepare for the 2023 W9 fillable form is now! Understanding how to complete the form correctly and in time can save you from many potential drawbacks. Remember - providing false information on this form is a federal offense. So, do it properly, carefully follow the instructions, and, if you need assistance, ask for help from a professional tax preparer or accountant. Fill Now

W-9 Fillable Form for 2023 First things first, the IRS W9 fillable form in 2023 is a critical document to provide information to the Internal Revenue Service about your tax status in the United States. This form verifies your identity and certifies that you are not subject to backup withholding. It is typically requested by those who pay you income, seeing as it provides them with an accurate taxpayer identification number (TIN) to report to the IRS. IRS Form W-9 for 2023: Keep Up With the Changes Like any other official document, the IRS revises the form periodically to comply with new taxation laws, requirements, and provisions. For instance, in the free W-9 fillable form for 2023, the IRS introduced sections to include the foreign individuals' foreign tax identifying number (FTIN). Since changes may affect how to correctly fill out the W-9 form, it is recommended to check the instructions provided by the IRS to avoid mistakes and potential penalties. Who Can and Cannot Use Form W-9 It's essential to understand that Form W-9 fillable for 2023 may not be for everyone. The form might be used only by the U.S. persons, including: citizens, resident aliens, specific types of trusts and estates, specific business entities. In other words, if you are a foreign individual, foreign business, or represent a foreign trust, you should not use W-9; instead, you will likely need to use Form W-8 series. Maximize the Benefits of the W-9 Form Filing and managing the IRS W9 form for 2023 fillable can seem a bit intimidating at first. Still, when done right, it can help avoid unnecessary tax intricacies. Pay special attention when filling out Section 2 of the template, which asks for your TIN. Providing valid and correct information in this section is important, as incorrect information may lead to backup withholding or penalties. Preparing the W9 Fillable Form for 2023 The perfect time to get acquainted and prepare for the 2023 W9 fillable form is now! Understanding how to complete the form correctly and in time can save you from many potential drawbacks. Remember - providing false information on this form is a federal offense. So, do it properly, carefully follow the instructions, and, if you need assistance, ask for help from a professional tax preparer or accountant. Fill Now -

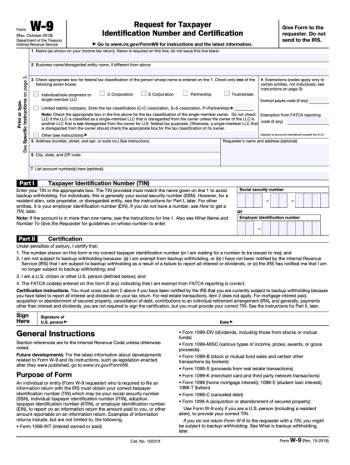

![image]() Fillable W-9 Form (PDF) In most instances, as a U.S. citizen, whether individual or corporate, you may be required to complete and submit a W-9 form. This document is instrumental in accurately identifying taxpayers who must report an income received. Now think about an instance where a financial institution requests your TIN (Taxpayer Identification Number) and certifications for a new account you've opened. In such a case, the IRS W-9 PDF fillable form becomes an essential document to provide. You could also rendezvous with situations where you are operating a business and have contracted a freelancer for their services. Now, to accurately report your tax information, you need to collect the freelancer's TIN. The best and most convenient registered form for this is the W-9 form PDF fillable. Understanding this context makes it easier for taxpayers to comprehend why this document is vital in financial transactions. Steps to Correct Errors in the W-9 Form Sometimes, errors may occur when filling out any tax form, and the W9 PDF fillable form is no exception. Such a mistake can lead to miscommunication or issues with the IRS, which we all want to avoid. Hence, knowing how to promptly and accurately fix any error is crucial. For instance, you might mistakenly use your social security number instead of your taxpayer identification number. Understanding the discrepancy and recognizing where this piece of information goes as it pertains to the fillable W-9 form in PDF will make the correction process smoother and reduce the possibility of errors in the future. Popular Questions Regarding the W-9 Tax Form Contrary to common perception, the W-9 form is not as intimidating or complicated as it may seem. There are many common queries about the W-9 form as a fillable PDF, some of which we will address here. How often should a W-9 form be updated?There's no defined timeline to update your W-9 form. However, consider updating it whenever your information, such as your name or address, changes significantly. What should be done if a mistake is made while filling out the form?If errors are made, it is advised to complete a new form instead of altering the already submitted one. This escalates both clarity and accuracy. Who is responsible for submitting the W-9 form?The person or entity providing the service or the one whose income is being reported should complete and submit the W-9 form. Fill Now

Fillable W-9 Form (PDF) In most instances, as a U.S. citizen, whether individual or corporate, you may be required to complete and submit a W-9 form. This document is instrumental in accurately identifying taxpayers who must report an income received. Now think about an instance where a financial institution requests your TIN (Taxpayer Identification Number) and certifications for a new account you've opened. In such a case, the IRS W-9 PDF fillable form becomes an essential document to provide. You could also rendezvous with situations where you are operating a business and have contracted a freelancer for their services. Now, to accurately report your tax information, you need to collect the freelancer's TIN. The best and most convenient registered form for this is the W-9 form PDF fillable. Understanding this context makes it easier for taxpayers to comprehend why this document is vital in financial transactions. Steps to Correct Errors in the W-9 Form Sometimes, errors may occur when filling out any tax form, and the W9 PDF fillable form is no exception. Such a mistake can lead to miscommunication or issues with the IRS, which we all want to avoid. Hence, knowing how to promptly and accurately fix any error is crucial. For instance, you might mistakenly use your social security number instead of your taxpayer identification number. Understanding the discrepancy and recognizing where this piece of information goes as it pertains to the fillable W-9 form in PDF will make the correction process smoother and reduce the possibility of errors in the future. Popular Questions Regarding the W-9 Tax Form Contrary to common perception, the W-9 form is not as intimidating or complicated as it may seem. There are many common queries about the W-9 form as a fillable PDF, some of which we will address here. How often should a W-9 form be updated?There's no defined timeline to update your W-9 form. However, consider updating it whenever your information, such as your name or address, changes significantly. What should be done if a mistake is made while filling out the form?If errors are made, it is advised to complete a new form instead of altering the already submitted one. This escalates both clarity and accuracy. Who is responsible for submitting the W-9 form?The person or entity providing the service or the one whose income is being reported should complete and submit the W-9 form. Fill Now -

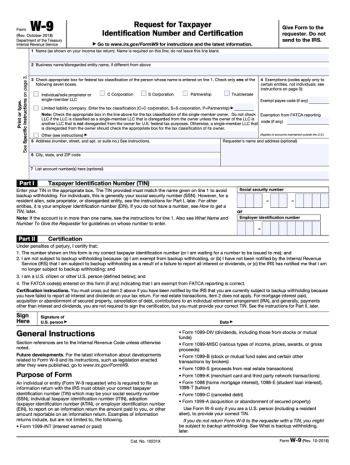

![image]() Fillable IRS Form W-9 If you are a contractor, it's critical to understand the requisite tax paperwork, such as the fillable W-9 form from the IRS. Businesses generally request this form from freelancers and independent contractors. This document is fundamental to complying with the IRS's tax obligations and prevents potential tax problems in the future. Thankfully, our website has a blank W-9 template for free to ensure easy accessibility. The Essentials of Form W-9 in 2023 Form W-9 provides necessary tax information to entities that will pay you income during the tax year. This is typically employment income but can also include income from freelance work, interest, or dividends. It's important to understand that Form W-9 fillable from the IRS, does not get directly sent to the Internal Revenue Service. Instead, it's used by businesses to populate other tax documents like the 1099-MISC (Miscellaneous Income) tax forms, which they then send to the IRS. Correctly Navigating the Fillable W-9 Tax Form As we move into another tax year, contractors need to update their tax paperwork. The IRS W-9 fillable for 2023 contains several boxes to fill in. This includes the following: contractor's business name, if applicable, their address and contact information, the business entity type (whether you are a sole proprietor, a partnership, an S corporation, and so on), and most importantly - your taxpayer identification number, usually your SSN (Social Security Number) or EIN (Employer Identification Number). Completing these forms correctly is crucial to avoiding any potential tax issues. Using the Fillable IRS Form W-9 The fillable IRS Form W-9 is simple to fill out if you have all the necessary information. The top portion of the form requires your primary identification information, including your name and business name (if different from yours). You are also asked to determine your tax classification and provide your address and taxpayer identification number. Continually Updating Your W-9 Form As a freelancer or independent contractor, more is needed to submit a W-9 form once and remember about it. If your personal or business details change - for instance, a change in address or entity status or the usage of a new Tax Identification Number contrary to what was previously used—it will necessitate a new W-9 form. Therefore, updating your tax documents, particularly your W-9 form, is crucial in ensuring full compliance with IRS norms and avoiding unnecessary tax complications. Form W-9 is an important tax document for independent contractors and freelancers, and accurate completion is crucial. Adhering to IRS guidelines and ensuring regular document updates can save you from unwanted tax trouble. Take advantage of resources like our free IRS fillable W-9 form and keep abreast of changes to stay confidently tax compliant. Fill Now

Fillable IRS Form W-9 If you are a contractor, it's critical to understand the requisite tax paperwork, such as the fillable W-9 form from the IRS. Businesses generally request this form from freelancers and independent contractors. This document is fundamental to complying with the IRS's tax obligations and prevents potential tax problems in the future. Thankfully, our website has a blank W-9 template for free to ensure easy accessibility. The Essentials of Form W-9 in 2023 Form W-9 provides necessary tax information to entities that will pay you income during the tax year. This is typically employment income but can also include income from freelance work, interest, or dividends. It's important to understand that Form W-9 fillable from the IRS, does not get directly sent to the Internal Revenue Service. Instead, it's used by businesses to populate other tax documents like the 1099-MISC (Miscellaneous Income) tax forms, which they then send to the IRS. Correctly Navigating the Fillable W-9 Tax Form As we move into another tax year, contractors need to update their tax paperwork. The IRS W-9 fillable for 2023 contains several boxes to fill in. This includes the following: contractor's business name, if applicable, their address and contact information, the business entity type (whether you are a sole proprietor, a partnership, an S corporation, and so on), and most importantly - your taxpayer identification number, usually your SSN (Social Security Number) or EIN (Employer Identification Number). Completing these forms correctly is crucial to avoiding any potential tax issues. Using the Fillable IRS Form W-9 The fillable IRS Form W-9 is simple to fill out if you have all the necessary information. The top portion of the form requires your primary identification information, including your name and business name (if different from yours). You are also asked to determine your tax classification and provide your address and taxpayer identification number. Continually Updating Your W-9 Form As a freelancer or independent contractor, more is needed to submit a W-9 form once and remember about it. If your personal or business details change - for instance, a change in address or entity status or the usage of a new Tax Identification Number contrary to what was previously used—it will necessitate a new W-9 form. Therefore, updating your tax documents, particularly your W-9 form, is crucial in ensuring full compliance with IRS norms and avoiding unnecessary tax complications. Form W-9 is an important tax document for independent contractors and freelancers, and accurate completion is crucial. Adhering to IRS guidelines and ensuring regular document updates can save you from unwanted tax trouble. Take advantage of resources like our free IRS fillable W-9 form and keep abreast of changes to stay confidently tax compliant. Fill Now -

![image]() Free W-9 Fillable Form With the fast pace of technological advancements, the IRS has stayed strong. It has digitalized one of its most used tax forms. This transition is the transformation of the W-9 form from physical to digital. If you've been wondering about the free fillable W9 form for 2023, this article sheds light on all the crucial details you need to know! The IRS W9 Form Basics Before we dive into the specifics of the free fillable IRS W-9 form, let's first understand its purpose. The W-9 form serves as a request for a Taxpayer Identification Number (TIN) and Certification. Businesses use W-9 forms to obtain key information from their contractors, freelancers, or other non-employees. This documented data is subsequently used to fill out informational 1099 tax forms. As with many other aspects of today’s world, convenience and efficiency are paramount, and tax collection processes are no exception. To streamline these processes, the IRS has made available the free W-9 fillable form for 2023 online. It's designed to facilitate easy completion, submission, and storage digitally. Navigating through Free Fillable W9 in 2023 Navigating through the digital W-9 form is simple. With a user-friendly interface, all it takes is a few steps to fill out the necessary information accurately. Simply go to the download page, click on the form, and input your details in the required fields. Once complete, you can send it directly via email or save it for future reference. The Perks of Going Digital Embracing the W9 free fillable form comes with numerous benefits. Firstly, it saves you from the hassle of dealing with physical paperwork. Secondly, it significantly speeds up submitting and receiving tax forms. Lastly, it's environmentally friendly- a commendable step towards reducing paper consumption and promoting sustainability. Staying Secure, Staying Compliant While digitalizing the W-9 form increases convenience, it's equally crucial to ensure data security. Thankfully, the IRS ensures the digital form is secure and adheres to strict data protection measures. The free fillable IRS W-9 form is hosted on secure servers, and the information transmitted is encrypted. So you can fill your details with peace of mind, knowing that your sensitive information is well-protected. In this ever-evolving digital era, it's only fitting that even the tax processes advance and adapt. The free fillable W9 form in 2023 is a testament to this progress, ensuring convenience and compliance. Don't shy away from embracing this digital shift! Fill Now

Free W-9 Fillable Form With the fast pace of technological advancements, the IRS has stayed strong. It has digitalized one of its most used tax forms. This transition is the transformation of the W-9 form from physical to digital. If you've been wondering about the free fillable W9 form for 2023, this article sheds light on all the crucial details you need to know! The IRS W9 Form Basics Before we dive into the specifics of the free fillable IRS W-9 form, let's first understand its purpose. The W-9 form serves as a request for a Taxpayer Identification Number (TIN) and Certification. Businesses use W-9 forms to obtain key information from their contractors, freelancers, or other non-employees. This documented data is subsequently used to fill out informational 1099 tax forms. As with many other aspects of today’s world, convenience and efficiency are paramount, and tax collection processes are no exception. To streamline these processes, the IRS has made available the free W-9 fillable form for 2023 online. It's designed to facilitate easy completion, submission, and storage digitally. Navigating through Free Fillable W9 in 2023 Navigating through the digital W-9 form is simple. With a user-friendly interface, all it takes is a few steps to fill out the necessary information accurately. Simply go to the download page, click on the form, and input your details in the required fields. Once complete, you can send it directly via email or save it for future reference. The Perks of Going Digital Embracing the W9 free fillable form comes with numerous benefits. Firstly, it saves you from the hassle of dealing with physical paperwork. Secondly, it significantly speeds up submitting and receiving tax forms. Lastly, it's environmentally friendly- a commendable step towards reducing paper consumption and promoting sustainability. Staying Secure, Staying Compliant While digitalizing the W-9 form increases convenience, it's equally crucial to ensure data security. Thankfully, the IRS ensures the digital form is secure and adheres to strict data protection measures. The free fillable IRS W-9 form is hosted on secure servers, and the information transmitted is encrypted. So you can fill your details with peace of mind, knowing that your sensitive information is well-protected. In this ever-evolving digital era, it's only fitting that even the tax processes advance and adapt. The free fillable W9 form in 2023 is a testament to this progress, ensuring convenience and compliance. Don't shy away from embracing this digital shift! Fill Now -

![image]() W-9 Online Fillable Form Before diving deep into the specifics of the W-9 form fillable online, we should first understand its primary purpose and significance. Often demanded by businesses and financial institutions, a W-9 form is essential for capturing the taxpayer Identification number or social security number. When you're hired as a contractor, freelancer, or vendor to a company, the form helps you prepare the 1099-MISC copy at the end of the year. This IRS Form 1099-MISC serves as a record of the salary, reward, or commission you received. Convenience of an Online Fillable W-9 Form Technology has made our lives easier, and this benefit extends to our interactions with taxation forms. And the widely known W9 online fillable form is one such example. It works as a digital version of the traditional paper form and includes edit-friendly fields to fill out details. You can complete it from your laptop or smartphone in a few minutes without needing a printer, ink, or an envelope. Emerging Challenges in Online Submission While the online fillable W-9 form adds convenience to the filling process, there can be some setbacks that a taxpayer might encounter. One potential challenge is ensuring the form's safe and secure transmission because the document includes sensitive data, like your Social Security Number. Also, navigating through the form could be difficult for those who need to be better versed in the technology. However, with proper guidance about online tools and forms, these challenges can be tackled effectively. A Step-by-Step Guide to Complete the W-9 Form Online In general, completing the W-9 online fillable for free can be quick and easy if you know what's required. So, let's break down the steps for a smoother experience: Open the blank W-9 template by following the link on our website. You'll access the relevant W-9 copy and the various tools to edit and complete the sample online. Fill out your legal name, business name (if applicable), Federal Tax Classification, address, and Taxpayer Identification Number. Go through the information provided, making sure all details are accurate. Any error may lead to future complications. Submit the form to the requester electronically, ensuring a secure transmission method. As we wrap up, remember to be careful while filling in the form. If in doubt, consult with a tax professional to ensure you're doing everything right. With these key insights, you’re now well-prepared to engage with an online W-9 fillable form. Stay informed and make tax time simpler! Fill Now

W-9 Online Fillable Form Before diving deep into the specifics of the W-9 form fillable online, we should first understand its primary purpose and significance. Often demanded by businesses and financial institutions, a W-9 form is essential for capturing the taxpayer Identification number or social security number. When you're hired as a contractor, freelancer, or vendor to a company, the form helps you prepare the 1099-MISC copy at the end of the year. This IRS Form 1099-MISC serves as a record of the salary, reward, or commission you received. Convenience of an Online Fillable W-9 Form Technology has made our lives easier, and this benefit extends to our interactions with taxation forms. And the widely known W9 online fillable form is one such example. It works as a digital version of the traditional paper form and includes edit-friendly fields to fill out details. You can complete it from your laptop or smartphone in a few minutes without needing a printer, ink, or an envelope. Emerging Challenges in Online Submission While the online fillable W-9 form adds convenience to the filling process, there can be some setbacks that a taxpayer might encounter. One potential challenge is ensuring the form's safe and secure transmission because the document includes sensitive data, like your Social Security Number. Also, navigating through the form could be difficult for those who need to be better versed in the technology. However, with proper guidance about online tools and forms, these challenges can be tackled effectively. A Step-by-Step Guide to Complete the W-9 Form Online In general, completing the W-9 online fillable for free can be quick and easy if you know what's required. So, let's break down the steps for a smoother experience: Open the blank W-9 template by following the link on our website. You'll access the relevant W-9 copy and the various tools to edit and complete the sample online. Fill out your legal name, business name (if applicable), Federal Tax Classification, address, and Taxpayer Identification Number. Go through the information provided, making sure all details are accurate. Any error may lead to future complications. Submit the form to the requester electronically, ensuring a secure transmission method. As we wrap up, remember to be careful while filling in the form. If in doubt, consult with a tax professional to ensure you're doing everything right. With these key insights, you’re now well-prepared to engage with an online W-9 fillable form. Stay informed and make tax time simpler! Fill Now -

![image]() Blank W9 Fillable Form The blank W9 fillable form for 2023 is a vital Internal Revenue Service (IRS) document in the United States. Businesses generally use it to request your taxpayer identification number (TIN). Think of it as an identification card that helps the IRS recognize you for tax purposes. This form is necessary as it enables businesses to prepare their tax reports, such as income paid to you or payments made on your behalf during the taxable year. Who Cannot Use Form W-9? It's worth noting that while blank W9 fillable and printable is commonly used, not everyone can utilize it. Certain individuals are not eligible to use the form, such as non-resident aliens, withholding foreign partnership or trust, or any person prohibited from receiving US-source income. Understanding Form W-9 with an Example Let's consider a hypothetical scenario that serves as a real-world application for a blank Form W-9 fillable. Jane, a professional consultant, has been hired by ABC Corp as an independent contractor. ABC Corp will ask Jane to fill out the Form W-9 before she commences her project. Jane will provide her TIN and certify its validity by signing the form. The filled form will later help ABC Corp. in reporting the payments made to Jane. Form W-9 Issues and Solutions Common Issues Solutions Mistaken identity due to incorrect TIN Double-check the TIN when filling out the blank W-9 fillable Loss of privacy with TIN exposed Ensure that Form W-9 is exchanged via secure means Uncertainty regarding how to fill out the form Refer to the IRS website for a step-by-step guide The Paperless Multiply: Embrace Digital Technology You are liberated to select the choice that suits you the best, be it blank W-9 fillable or printable. Both these versions are available online on the official IRS website. With the online version, you can easily fill it out online, save it, and forward it securely, contributing to a paperless environment. In essence, the W-9 form is a simple but crucial document for both businesses and independent contractors. Understanding it in-depth helps ensure compliance with U.S. tax laws and aids in the smooth operation of financial transactions. Fill Now

Blank W9 Fillable Form The blank W9 fillable form for 2023 is a vital Internal Revenue Service (IRS) document in the United States. Businesses generally use it to request your taxpayer identification number (TIN). Think of it as an identification card that helps the IRS recognize you for tax purposes. This form is necessary as it enables businesses to prepare their tax reports, such as income paid to you or payments made on your behalf during the taxable year. Who Cannot Use Form W-9? It's worth noting that while blank W9 fillable and printable is commonly used, not everyone can utilize it. Certain individuals are not eligible to use the form, such as non-resident aliens, withholding foreign partnership or trust, or any person prohibited from receiving US-source income. Understanding Form W-9 with an Example Let's consider a hypothetical scenario that serves as a real-world application for a blank Form W-9 fillable. Jane, a professional consultant, has been hired by ABC Corp as an independent contractor. ABC Corp will ask Jane to fill out the Form W-9 before she commences her project. Jane will provide her TIN and certify its validity by signing the form. The filled form will later help ABC Corp. in reporting the payments made to Jane. Form W-9 Issues and Solutions Common Issues Solutions Mistaken identity due to incorrect TIN Double-check the TIN when filling out the blank W-9 fillable Loss of privacy with TIN exposed Ensure that Form W-9 is exchanged via secure means Uncertainty regarding how to fill out the form Refer to the IRS website for a step-by-step guide The Paperless Multiply: Embrace Digital Technology You are liberated to select the choice that suits you the best, be it blank W-9 fillable or printable. Both these versions are available online on the official IRS website. With the online version, you can easily fill it out online, save it, and forward it securely, contributing to a paperless environment. In essence, the W-9 form is a simple but crucial document for both businesses and independent contractors. Understanding it in-depth helps ensure compliance with U.S. tax laws and aids in the smooth operation of financial transactions. Fill Now -

![image]() IRS Form W-9 & Interest Payments Form W-9 plays a crucial role in the financial operations of entities and individuals in the United States. It is a requirement by the Internal Revenue Service (IRS) to gather taxpayer details, including an individual's or company's name, address, and Taxpayer Identification Number (TIN). These details are helpful when distributing income earned from dividends and interest rates, among other taxable distributions. Here, we will discuss the usage of Form W-9 by financial institutions and investment companies for dividend and interest income reporting. Utilization of Form W-9 in Financial Institutions Financial institutions, including banks and credit unions, employ Form W-9 regularly. Typically, a client opening a new account with a financial institution will be prompted to fill out a W-9 form. This information is necessary for the institution to report the interest earned on those accounts to the IRS. When a client's account earns interest or dividends exceeding $10, the bank must file a return with the IRS using Form 1099. Form W-9 in Investment Companies Investment companies are another critical player who often use Form W-9. Investors are usually requested to provide a completed Form W-9 when opening a brokerage account. If the account or investment earns dividends, the relevant company has to report these gains to the IRS. Moreover, a Form 1099-DIV will be issued, which summarizes the annual dividends and any capital gains distributions. Why is Form W-9 Important? Form W-9 is essential to IRS income tracking. The form allows the IRS to track income from various avenues, including dividends and interest income, ensuring that all taxable income is adequately reported and taxed The form is evidence of exempt status. Some entities and individuals are exempt from backup withholding. To establish and certify this exemption status, they would require a completed Form W-9. The form helps prevent penalties. Failure to provide a correct TIN can lead to penalties. However, a duly completed and accurate Form W-9 will help prevent such penalties. Final Words The importance of Form W-9 cannot be underestimated for individuals, entities, financial institutions, and investment companies. It is the cornerstone of the withholding, reporting, and taxation process. Ensuring its correct completion and use can help to prevent unwelcome issues with the IRS, including penalties for underpayment or nonpayment of taxes. Understanding the connection between Form W-9, dividend and interest payments, and the IRS is essential for effective account management and tax preparation. Ensure to seek guidance from a tax professional if unsure about the Form W-9 or any other tax-related issues. Fill Now

IRS Form W-9 & Interest Payments Form W-9 plays a crucial role in the financial operations of entities and individuals in the United States. It is a requirement by the Internal Revenue Service (IRS) to gather taxpayer details, including an individual's or company's name, address, and Taxpayer Identification Number (TIN). These details are helpful when distributing income earned from dividends and interest rates, among other taxable distributions. Here, we will discuss the usage of Form W-9 by financial institutions and investment companies for dividend and interest income reporting. Utilization of Form W-9 in Financial Institutions Financial institutions, including banks and credit unions, employ Form W-9 regularly. Typically, a client opening a new account with a financial institution will be prompted to fill out a W-9 form. This information is necessary for the institution to report the interest earned on those accounts to the IRS. When a client's account earns interest or dividends exceeding $10, the bank must file a return with the IRS using Form 1099. Form W-9 in Investment Companies Investment companies are another critical player who often use Form W-9. Investors are usually requested to provide a completed Form W-9 when opening a brokerage account. If the account or investment earns dividends, the relevant company has to report these gains to the IRS. Moreover, a Form 1099-DIV will be issued, which summarizes the annual dividends and any capital gains distributions. Why is Form W-9 Important? Form W-9 is essential to IRS income tracking. The form allows the IRS to track income from various avenues, including dividends and interest income, ensuring that all taxable income is adequately reported and taxed The form is evidence of exempt status. Some entities and individuals are exempt from backup withholding. To establish and certify this exemption status, they would require a completed Form W-9. The form helps prevent penalties. Failure to provide a correct TIN can lead to penalties. However, a duly completed and accurate Form W-9 will help prevent such penalties. Final Words The importance of Form W-9 cannot be underestimated for individuals, entities, financial institutions, and investment companies. It is the cornerstone of the withholding, reporting, and taxation process. Ensuring its correct completion and use can help to prevent unwelcome issues with the IRS, including penalties for underpayment or nonpayment of taxes. Understanding the connection between Form W-9, dividend and interest payments, and the IRS is essential for effective account management and tax preparation. Ensure to seek guidance from a tax professional if unsure about the Form W-9 or any other tax-related issues. Fill Now -

![image]() Tax Form W-9 & Real Estate Transactions When buying or selling real estate property, it is essential to understand the various legal and tax implications involved. One crucial form to be aware of is IRS Form W-9, Request for Taxpayer Identification Number and Certification. This document certifies and provides the taxpayer identification number (TIN) or social security number (SSN). It plays a significant role in most real estate transactions, especially for tax reporting purposes. This article delves into how buyers and sellers use Form W-9 in real estate transactions. The Buyer's Perspective From a buyer's perspective, Form W-9 is vital as it helps maintain compliance with the law. The form provides a mechanism for reporting payments made to the seller during a real estate transaction. Buyers, particularly those who purchase rental properties, may require the W-9 form from their sellers to report income from the property. Use of Federal Form W-9 The buyer uses IRS Form W-9 primarily to confirm the sellers' identity, report income, and report payments, particularly if the income generated from the property is above $600. It also precludes any withholding on the transactions by providing the necessary information to process IRS Form 1099. The Seller's Perspective Providing a completed Form W-9 is a critical step in the closing process for the seller. The W-9 ensures accurate reporting of income to the IRS. Sellers must provide accurate information to avoid penalties for incorrect reporting due to input of the wrong identification number. Use of the W-9 Tax Form A seller in a real estate transaction provides Form W-9 to the buyer or the escrow company handling the transaction. The form assists in verifying the seller’s taxpayer identification number or Social Security number. If a seller fails to supply a correctly completed Form W-9, the buyer may be obligated to withhold a portion of the payment otherwise due to the seller. In sum, understanding the use and importance of form W-9 is crucial for both parties involved in real estate transactions. For buyers, it helps ensure lawful reporting of income and transaction information. Whereas for sellers, it supports accurate income reporting and identification. Thus, properly and accurately completing Form W-9 facilitates a smooth real estate transaction. Fill Now

Tax Form W-9 & Real Estate Transactions When buying or selling real estate property, it is essential to understand the various legal and tax implications involved. One crucial form to be aware of is IRS Form W-9, Request for Taxpayer Identification Number and Certification. This document certifies and provides the taxpayer identification number (TIN) or social security number (SSN). It plays a significant role in most real estate transactions, especially for tax reporting purposes. This article delves into how buyers and sellers use Form W-9 in real estate transactions. The Buyer's Perspective From a buyer's perspective, Form W-9 is vital as it helps maintain compliance with the law. The form provides a mechanism for reporting payments made to the seller during a real estate transaction. Buyers, particularly those who purchase rental properties, may require the W-9 form from their sellers to report income from the property. Use of Federal Form W-9 The buyer uses IRS Form W-9 primarily to confirm the sellers' identity, report income, and report payments, particularly if the income generated from the property is above $600. It also precludes any withholding on the transactions by providing the necessary information to process IRS Form 1099. The Seller's Perspective Providing a completed Form W-9 is a critical step in the closing process for the seller. The W-9 ensures accurate reporting of income to the IRS. Sellers must provide accurate information to avoid penalties for incorrect reporting due to input of the wrong identification number. Use of the W-9 Tax Form A seller in a real estate transaction provides Form W-9 to the buyer or the escrow company handling the transaction. The form assists in verifying the seller’s taxpayer identification number or Social Security number. If a seller fails to supply a correctly completed Form W-9, the buyer may be obligated to withhold a portion of the payment otherwise due to the seller. In sum, understanding the use and importance of form W-9 is crucial for both parties involved in real estate transactions. For buyers, it helps ensure lawful reporting of income and transaction information. Whereas for sellers, it supports accurate income reporting and identification. Thus, properly and accurately completing Form W-9 facilitates a smooth real estate transaction. Fill Now -

![image]() Form W-9 for Small Businesses Every small business owner must be adept at navigating the complex world of taxation to stay compliant with the law. One of the forms frequently used by small businesses is the IRS Form W-9. This important document serves a vital purpose when dealing with contractors and vendors. Let's explore the role of Form W-9 in small businesses and the best practices for its management and compliance. The Purpose of the W-9 Tax Form Form W-9, technically called the "Request for Taxpayer Identification Number and Certification," is used by businesses to request the Taxpayer Identification Number (TIN), and sometimes, certification, from vendors or contractors with whom they do business. It's essential to remember that Form W-9 does not need to be submitted to the IRS by your company. Instead, it should be kept in your records because it will be invaluable in producing other IRS forms, such as the 1099 series. Compliance with IRS Form W-9 Compliance is critical when it comes to handling tax forms, and managing Form W-9 is no exception. Requesting Form W-9Every time you engage in business with a new vendor or freelance contractor, you must request a completed Form W-9 before issuing any payment. W-9 VerificationAs the payer, you're not directly responsible for verifying the information your vendors provide. However, your business may face penalties if the TIN provided is incorrect. StorageOnce you have obtained the completed Form W-9, ensure it's safeguarded. These forms contain sensitive data and must be protected from potential security threats. Best Practices for Managing Form W-9 Proper management of Form W-9 can prevent many avoidable headaches. Here are some best practices to consider: Keep A BackupThe sudden loss of such critical records can be disastrous. Thus, always keep a backup either digitally or physically. Stay OrganizedKeep track of your Forms W-9. Maintain an organized log of vendor forms for easy access when needed. Annual VerificationAt least once a year, check that the vendors' or contractors’ information in their W-9s is still accurate. Seek Professional HelpUnderstanding tax laws and requirements can be complex. Hiring a tax professional to provide guidance may save you significant time and effort if in doubt. To sum up, understanding, managing, and staying compliant with IRS Form W-9 is crucial for any small business owner. Proactively mitigating any tax-related risks by following these best practices will undoubtedly help keep your business on track for success. Fill Now

Form W-9 for Small Businesses Every small business owner must be adept at navigating the complex world of taxation to stay compliant with the law. One of the forms frequently used by small businesses is the IRS Form W-9. This important document serves a vital purpose when dealing with contractors and vendors. Let's explore the role of Form W-9 in small businesses and the best practices for its management and compliance. The Purpose of the W-9 Tax Form Form W-9, technically called the "Request for Taxpayer Identification Number and Certification," is used by businesses to request the Taxpayer Identification Number (TIN), and sometimes, certification, from vendors or contractors with whom they do business. It's essential to remember that Form W-9 does not need to be submitted to the IRS by your company. Instead, it should be kept in your records because it will be invaluable in producing other IRS forms, such as the 1099 series. Compliance with IRS Form W-9 Compliance is critical when it comes to handling tax forms, and managing Form W-9 is no exception. Requesting Form W-9Every time you engage in business with a new vendor or freelance contractor, you must request a completed Form W-9 before issuing any payment. W-9 VerificationAs the payer, you're not directly responsible for verifying the information your vendors provide. However, your business may face penalties if the TIN provided is incorrect. StorageOnce you have obtained the completed Form W-9, ensure it's safeguarded. These forms contain sensitive data and must be protected from potential security threats. Best Practices for Managing Form W-9 Proper management of Form W-9 can prevent many avoidable headaches. Here are some best practices to consider: Keep A BackupThe sudden loss of such critical records can be disastrous. Thus, always keep a backup either digitally or physically. Stay OrganizedKeep track of your Forms W-9. Maintain an organized log of vendor forms for easy access when needed. Annual VerificationAt least once a year, check that the vendors' or contractors’ information in their W-9s is still accurate. Seek Professional HelpUnderstanding tax laws and requirements can be complex. Hiring a tax professional to provide guidance may save you significant time and effort if in doubt. To sum up, understanding, managing, and staying compliant with IRS Form W-9 is crucial for any small business owner. Proactively mitigating any tax-related risks by following these best practices will undoubtedly help keep your business on track for success. Fill Now